Finally after much hue and cry, the United States House of Representatives has passed a deal to let the US Government borrow another $2.2 trillion to pay its bills. However, the deal is still pending with Congress. The high voltage drama associated with United States public debt crisis is likely to downgrade the nation’s prized AAA credit rating. This is going to be a big loss for US economy. It may cause loss of business confidence and market panic. Market experts are smelling another potential recession in the US and possibly the world. I think, very few people know about United States’ public debt. So today I we are going to discuss the United States public debt crisis.

Finally after much hue and cry, the United States House of Representatives has passed a deal to let the US Government borrow another $2.2 trillion to pay its bills. However, the deal is still pending with Congress. The high voltage drama associated with United States public debt crisis is likely to downgrade the nation’s prized AAA credit rating. This is going to be a big loss for US economy. It may cause loss of business confidence and market panic. Market experts are smelling another potential recession in the US and possibly the world. I think, very few people know about United States’ public debt. So today I we are going to discuss the United States public debt crisis.

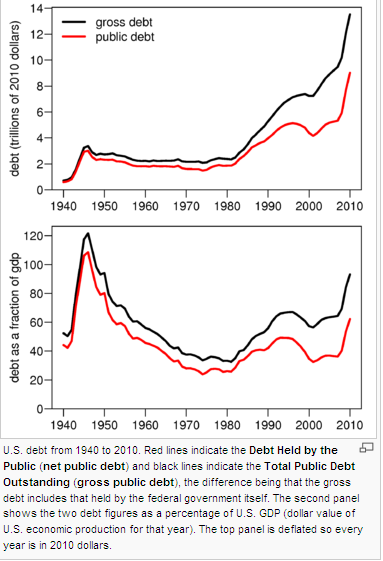

Like most of the governments in world, the US Government runs a budget deficit that lets it spend more each year than it raises in tax. The US has had public debt since its inception, which has escalated in more recent times to fund significant expenses like wars with Iraq and Afghanistan and stimulus packages during economic recession. As of June 29, 2011, the Total Public Debt Outstanding was $14.46 trillion and was approximately 98.6% of calendar year 2010’s annual gross domestic product (GDP) of $14.66 trillion.

As I have mentioned earlier, the deal is still pending with the Congress. Do you know what would happen if the agreement wasn’t passed? If it is not lifted by August 2, 2011, the US Treasury will run out of funds to meet regular payments like social security benefits, military pensions, contractor payments and interest. Means, world biggest economy will not be able to run itself. The US government will have to inform creditors that it can’t pay its bills. Moreover, the US will also lose its AAA credit rating. And a lower credit rating would mean the US government would have to pay investors a higher rate of interest on its borrowings. It will also impact the confidence of investors around the world.

So the overall situation is regarded as a crisis due to the potential for a major worsening of the economic status of the US in the case of a government default, such as rising borrowing costs or disruption if the government cannot pay its bills. The concern extends beyond the US, as countries with large dollar holdings watch for potential losses flowing from the crisis.