We will see the explanation behind Indian Rupee falling against American Dollar. Let us suppose that there are only two international traders between India and the United States. Mr. Bharat in Mumbai, India who supplies Diamonds to a store in Washington. Mr. Obama in Chicago who supplies computer parts in Noida. Now assume dollar price today is 50 rupees. Today Bharat sold 10 Diamond sets to Washington store, cost of each piece was 1000 dollars. Total selling amount = 10,000 dollars. Now Bharat wants to convert 10,000 dollars to Rupees. If rate is 50 rupees to 1 US dollar. After conversion Bharat should get 5 Lakh rupees.

We will see the explanation behind Indian Rupee falling against American Dollar. Let us suppose that there are only two international traders between India and the United States. Mr. Bharat in Mumbai, India who supplies Diamonds to a store in Washington. Mr. Obama in Chicago who supplies computer parts in Noida. Now assume dollar price today is 50 rupees. Today Bharat sold 10 Diamond sets to Washington store, cost of each piece was 1000 dollars. Total selling amount = 10,000 dollars. Now Bharat wants to convert 10,000 dollars to Rupees. If rate is 50 rupees to 1 US dollar. After conversion Bharat should get 5 Lakh rupees.

Same evening Mr. Obama from Chicago, sells one computer server in Noida for Rs. 2.5 lakhs. As per 50 rupees to dollar rate, Obama is expecting to convert Rs. 2.5 lakhs to 5000 US dollars.

So we have

— 10,000 US dollars to be converted to rupees. [After conversion worth Rs. 5 Lakhs]

— Rs. 2.5 Lakhs to be converted to dollars [After conversion worth 5000 US dollars]

We have a problem. Demand for Rupees is more than that for dollars. In other words for this particular trading day, there seems to be more supply of dollars than that of rupees.

Bharat and Obama log into Foreign Exchange website to convert their currency. First 5000 dollars gets exchanged easily. And the rate is Rs. 50 to 1 US dollars. Obama is happy to get his 2.5 lakhs converted to 5000 US dollars, he logs out of website and goes home.

Bharat still has more 5000 US dollars to convert in to Rupees. He got some money on credit from a friend and promised to return him on time with small interest fee. Bharat also wants to pay salary to his employees.

Bharat is now desperate to convert remaining 5000 dollars to rupees.

Lets add one more character in to story now.

Mr Desai who runs a Travel Agency and organises tours to countries like UK, USA, Asia etc. He logs to website and sees someone waiting to exchange 5000 US dollars to rupees. Desai knows that he will need US dollars sometime next month and was looking to buy some at good price. He offers a bargain. Last price for dollar was 50 rupees, but if someone sells dollars for 48 rupees, I will buy it.

Bharat being in rush, agrees to sell dollars for lower price. He converts remaining 5000 US dollars at rate of 48 rupees. 5000 x 48 = 2.4 lakhs. He doesn’t mind losing small amount because he will able to make payments on time.

Now latest exchange rate is: Rs. 48 to 1 US dollar.

After few weeks , Desai (Travel agent) gets a big contract to organise tour for a group of 100 people. He needs lot of dollars, he logs in to website and sees Bharat ready to sell 10,000 dollars for 52 rupees. Desai desperately needs dollars, he buys it.

Now exchange rate is: Rs. 52 to 1 US dollar.

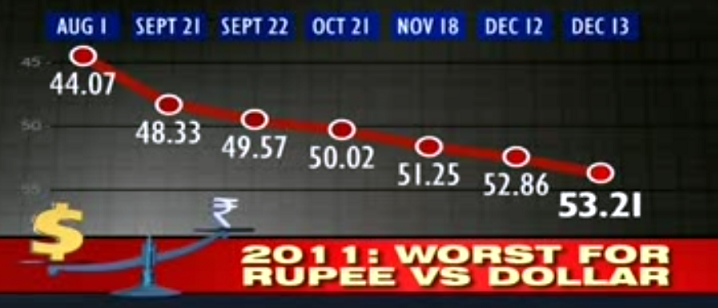

The Indian Rupee has slipped by over 20 per cent this year. Let’s see some latest reasons why Rupee is falling. There is an increased demand for dollars due to a spurt in crude oil prices and the flight of foreign funds from the Indian market and the demand for rupees, simultaneously, has dipped because capital inflows are down. Foreign institutional investors have sold Indian equities worth more than $500 million in just a few trading sessions. The rupee has been under tremendous pressure as foreign investors are getting out of the Indian markets due to the current slowdown in Indian economy and rising global uncertainties. Lack of economic reforms, policy paralysis, rising corruption and increased number of scams, growing fiscal deficit slow manufacturing and agricultural growth, rising interest rates and increased inflation are also increasing pressure on Indian Rupee.

Good article to understand foreign exchange how it operates.

Thanks,

Anand.

Call the limit ‘l’. Call N/l as x. Obviously, x is the best we can do, so the question rlealy is how well we can approach x in the worst case. In the case of checking 1, 2, 4, etc. it is hard to get good constant factors over x without finding out l pretty well (eg. if we find only highest power of 2 that does not exceed l, we can at best get a factor of 2x), so the binary search to find the limit seems to make more sense. In this case, suppose we find l completely first. Worst case is that l = N/(2^a) + 1 for some a. Here we will find the value of l after a (to find first power of 2 after dividing by which we can withdraw) + log (N/2^a)) (to query values between this and its double to find where l lies) queries = logN queries, and will only have removed 2l-1 from N after doing all this. Time taken here would be logN + (N-2l+1)/l, which is roughly logN + x – 2. This is quite good in terms of x, when log N is much smaller than x. Only problem is where log N is much more than x. However, this is easily dealt with. For log N to be more than x, l would have to exceed N/logN. While doing the binary search, if the first point where we are actually able to withdraw is more than this, then don’t waste time trying to find exact value of l. Instead, use what we have already found and withdraw all the money using that limit. Of course, total number of days is limited by logN here, but even in terms of x, we have a limit of 2x for even these ‘bad’ cases.