Transferring money to India from is as simple as sending email to someone. Just you need to fill and submit some online forms and follow easy instructions. You need to provide your recipient and payment information and you are all set for money transfer to India. There are many remittance websites which provide the facility of money transfer to India. You can transfer money to India using your US bank account, credit card, or debit card. The money transfers are paid out in INR. India is top recipient country of remittances across the world. Normally the remittance sites do not charge any fees if you send more than $1,000 and paying with your US bank account. I am going to share some of the top money transfer sites.

Transferring money to India from is as simple as sending email to someone. Just you need to fill and submit some online forms and follow easy instructions. You need to provide your recipient and payment information and you are all set for money transfer to India. There are many remittance websites which provide the facility of money transfer to India. You can transfer money to India using your US bank account, credit card, or debit card. The money transfers are paid out in INR. India is top recipient country of remittances across the world. Normally the remittance sites do not charge any fees if you send more than $1,000 and paying with your US bank account. I am going to share some of the top money transfer sites.

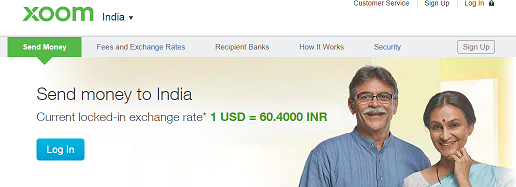

1. Xoom

Xoom is one of the most popular money transfer services on internet. It offers a secure, fast, and inexpensive way to send money to their relatives and friends in many countries including India.

- Xoom provides locked in rate so you need not to worry about exchange rate fluctuation.

- It offers instant deposits to ICICI Bank, PNB, HDFC Bank, Bank of Baroda, Union Bank of India, Federal Bank and Yes Bank during Indian banking business hours. For other banks, it takes 4 hours to process and complete the transfer request.

- There is no fees when you are sending more than $1,000 and paying with your US bank account. If you are transferring less than 1000 $ using your US Bank account then the transfer fees is $2.99. For credit card or debit card transfer less than $1000, the fees is $4.99

- With the help of Xoom, you can also send money to your NRE and NRO accounts.

- You can also track your transfer with the help of SMS updates, email notifications, online access from your PC or phone or call the Xoom support staff 24/7.

- You can transfer money to India using your US bank account, debit card or credit card.

- Daily Transfer Limit is $2,999.

2. TransFast

TransFast is another global player in remittance industry. It offers better locked-in rates than that of Xoom. It claims to transfer more than $30 BILLION on behalf of millions of customers in over 90 countries.

- TransFast also provides locked in rate which is on higher side when you compare TransFast with Xoom.

- Unlike Xoom, it does not offer instant deposit or 4 hours time to complete the transaction. It normally takes one business day to complete the transfer request. Using Transfast, you can either by a deposit into your relatives’ Indian bank account, or a pick up from one of its convenient bank partners or agent locations.

- Its transfer fee pattern is almost similar to that of Xoom, however the fees for using credit card or debit card for money transfer to India is higher.

- It also provides facility of sending money to your NRE and NRO Indian bank account.

- You can track your transaction by using the unique transaction number on TransFast site.

- Daily transfer Limit is $2,950.

Western Union is the oldest money transfer company, founded in 1871. To transfer money you can use credit card, debit card, and bank account. The receiving options are direct pick-up from any of the 50,000 agent locations in India, home delivery, and direct deposit to the bank account.

- At the time of writing this article, Western Union offers the best locked in rate.

- It takes around three days to complete if you are transferring to a bank account in India. Cash Pickup takes few minutes.

- For western union, the transfer fees is higher as compared to that of Xoom and Transfast.

- Daily Transfer Limit is $2,999.

4. Remit2India

Remit2India is another popular money transfer service provider. This company is in industry from last thirteen years and have helped millons of users to tranfer money to India.

- Unlike others, it does not provide locked-in rate for money transfer.

- No transfer fee for money transfer of more USD 1000 at a time.

- Various options are available to send money to India that includes ACH Transfer, Check Transfer, Online Transfer, and Wire Transfer. The money can be received via demand draft or direct deposit to the recipient’s bank account.

- The time required to receive money varies anywhere between 2-7 days depending on the type of service chosen by the sender.

- It gives many discount offers e.g FX Voucher that gives 10 extra paisa for every dollar you send. The Power 30 gives high exchange rate plus $10 extra on the first 3 transactions.

- It has various additional programs like Easy EMI where you can make regular payments to maintain your family and pay education and home loans. BillPay2India helps you pay bills and premiums in India.

- Daily Transfer Limit : ACH Transfer: $10,000, Wire Transfer Limit: $50,000.

5. MoneyGram

It is also another old player in remittance industry. It offers two types of remittance services: Same Day Service where the funds typically arrive in a day at an agent location and Economy Service where the money is deposited to the bank accounts. Its locked in rates are comparable to that of Western Union.

- It provides very high locked in rates.

- Transfer fees is $2.99.

- Transfer time is 10 minutes to 1 hr if paid by credit/debit card. 3 business if paid by bank account.

- Daily Transfer Limit: $9,999 (Agent Location), $2500 (Online).

- Provides only Cash Pickup.

There are many other remittance companies and public and private sector Indian banks which provide money transfer facility. Please let me know through comment form which one you use and find better, secure and more reliable as compared to others.

I always recommend Remitlite as it provides best services in Foreign Exchange & Money Transfer.

Now there N number of Site that allows transferring money to India, Better Compare before transferring, You can compare the Latest Rates using this website http://inr2day.com/remittance/usd-to-inr

Thank you for sharing all banks detail its really i required