This news is going to be the greatest source of relief to all the income tax payers in India. Today the finance minister of India, Pranab Mukherjee proposed a new tax code that aims to moderate and simplify the current income tax rates in India. The new tax code is likely to replace the 40 years old Income Tax Act. It also aims at bringing all other direct taxes like wealth tax under its area. According to this tax code, if your income is 9 lakh per annum then you have to pay only 90000 rupees as income tax to the Government. The Governemnt has also declared that this bill is going to be placed in the Winter Session of the Parliament. These are some of the most striking features of new tax code.

This news is going to be the greatest source of relief to all the income tax payers in India. Today the finance minister of India, Pranab Mukherjee proposed a new tax code that aims to moderate and simplify the current income tax rates in India. The new tax code is likely to replace the 40 years old Income Tax Act. It also aims at bringing all other direct taxes like wealth tax under its area. According to this tax code, if your income is 9 lakh per annum then you have to pay only 90000 rupees as income tax to the Government. The Governemnt has also declared that this bill is going to be placed in the Winter Session of the Parliament. These are some of the most striking features of new tax code.

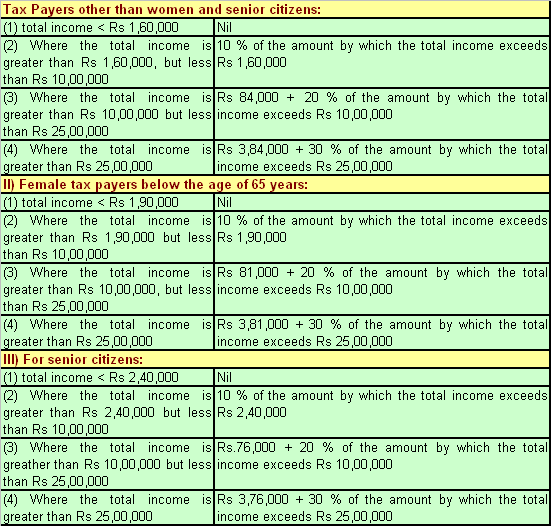

- No tax for income upto Rs 1.6 lakh.

- 10 % tax for Rs 10 lakh income

- 20 % tax for Rs 25 lakh income

- 30 % tax for income over Rs 25 lakh

- Corporate Tax down from 30 % to 25 %

- Wealth tax is to be levied for wealth above Rs 50 crore

- Interest on savings to be taxed

New Income Tax rates according to the new tax code ::